Use these links to rapidly review the document

Table of Contents

CD&A Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| AbbVie Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 4, 20188, 2020

The Annual Meeting of the Stockholders of AbbVie Inc. (the "Annual Meeting") will be held at the Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601, on Friday, May 4, 2018,8, 2020 at 9:00 a.m. CTCT. The safety of our stockholders is important to us, and given the current guidance by public health officials surrounding COVID-19 and group gatherings, this year's Annual Meeting will be a "virtual meeting" of stockholders. You will be able to attend the Annual Meeting, vote, and submit questions via live webcast by visiting www.virtualshareholdermeeting.com/ABBV2020. The Annual Meeting will be held for the following purposes:

Please promptly vote your shares by telephone, using the Internet, or by signing and returning your proxy in the enclosed envelope if you received a printed version of the proxy card.

The board of directors recommends that you vote FOR Items 1, 2, 3, 5, and 64 on the proxy card.

The board of directors recommends that you vote for an annual (1 YEAR) frequency of the stockholder advisory vote on executive compensation (Item 4).

The board of directors recommends that you vote AGAINST Items 7, 8,5, 6, and 97 on the proxy card.

The close of business on March 7, 2018,13, 2020, has been fixed as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting.

AbbVie's 20182020 Proxy Statement and 20172019 Annual Report on Form 10-K are available at www.abbvieinvestor.com. If you are a registered stockholder, you may access your proxy card by either:

AdmissionTo be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/ABBV2020, you must enter the control number found on your proxy card, voting instruction form or notice you received. You may vote during the Annual Meeting by following the instructions available on the meeting will be by admission card only. If you plan to attend, please complete and returnwebsite during the reservation form in the back of these materials and an admission card will be sent to you. Due to space limitations, reservation forms must be received before April 27, 2018. Each admission card, along with photo identification, admits one person. A stockholder may request two admission cards, but a guest must be accompanied by a stockholder.meeting.

By order of the board of directors.

Laura J. Schumacher

Secretary

March 19, 201823, 2020

Table of Contents |

Proxy Statement Summary | 1 | |

Information about the Annual Meeting | ||

Who Can Vote | ||

Notice and Access | ||

Voting by Proxy | ||

Revoking a Proxy | ||

Discretionary Voting Authority | ||

Quorum and Vote Required to Approve Each Item on the Proxy | ||

Effect of Broker Non-Votes and Abstentions | ||

Inspectors of Election | ||

Cost of Soliciting Proxies | ||

AbbVie Savings Plan | ||

Information Concerning Director Nominees (Item 1) | ||

The Board of Directors and its Committees | ||

Communicating with the Board of Directors | ||

Director Compensation | ||

Securities Ownership | ||

Executive Compensation | ||

Compensation Discussion and Analysis | ||

Compensation Committee Report | ||

Compensation Risk Assessment | ||

Summary Compensation Table | ||

| ||

| ||

| ||

Pension Benefits | ||

| ||

Potential Payments upon Termination or Change in Control | ||

Ratification of Ernst & Young LLP as AbbVie's Independent Registered Public Accounting Firm (Item 2) | ||

Audit Information | ||

Audit Fees and Non-Audit Fees | ||

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm | ||

Audit Committee Report | ||

Say on Pay—Advisory Vote on the Approval of Executive Compensation (Item 3) | ||

| ||

| ||

Management Proposal to Eliminate Supermajority Voting (Item | ||

Stockholder Proposals | ||

Stockholder Proposal on Lobbying Report (Item | ||

Stockholder Proposal | ||

Stockholder Proposal on Compensation Committee Drug Pricing Report (Item | ||

Additional Information |

The accompanying proxy is solicited on behalf of the board of directors for use at the Annual Meeting of Stockholders. The meetingAnnual Meeting will be held on Friday, May 4, 2018,8, 2020 at 9:00 a.m. CT. The safety of our stockholders is important to us, and given the Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601.current guidance by public health officials surrounding COVID-19 and group gatherings, this year's Annual Meeting will be a "virtual meeting" of stockholders. You will be able to attend the Annual Meeting, vote, and submit questions via live webcast by visiting www.virtualshareholdermeeting.com/ABBV2020.

This summary highlights selected information in the Proxy Statement.proxy statement. Please review the entire Proxy Statementproxy statement and the AbbVie 20172019 Annual Report before voting.

|

Date and Time: May 4, 20188, 2020 9:00 a.m. CT

Location: Fairmont Chicago, Millennium Park, 200 North Columbus Drive, Chicago, Illinois 60601The Annual Meeting will be a "virtual meeting" of stockholders. You will be able to attend the Annual Meeting, vote, and submit questions via live webcast by visiting www.virtualshareholdermeeting.com/ABBV2020.

Record Date: March 7, 201813, 2020

How to Vote:Stockholders as of the record date are entitled to vote via the Internet atwww.proxyvote.com; by telephone at 1-800-690-6903; by returning a completed proxy card; or in person atduring the Annual Meeting of Stockholders.

Voting Items and Board Recommendations |

| | | Board Recommendations | ||

|---|---|---|---|---|

| | | | | |

| Item 1 | Election of Directors | FOR All Nominees | ||

| Item 2 | Ratification of Independent Auditor | FOR | ||

| Item 3 | Say on Pay—Advisory Vote on the Approval of Executive Compensation | FOR | ||

| Item 4 | ||||

| Management Proposal to Eliminate Supermajority Voting | FOR | |||

| Item | Stockholder Proposal on Lobbying Report | AGAINST | ||

| Item | Stockholder Proposal | AGAINST | ||

| Item | Stockholder Proposal on Compensation Committee Drug Pricing Report | AGAINST |

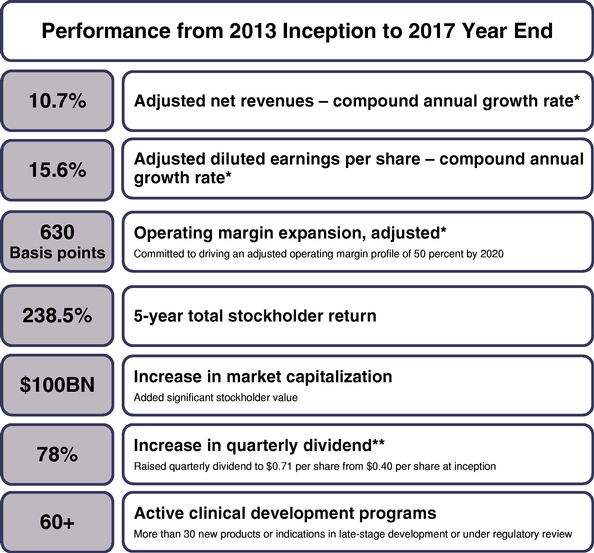

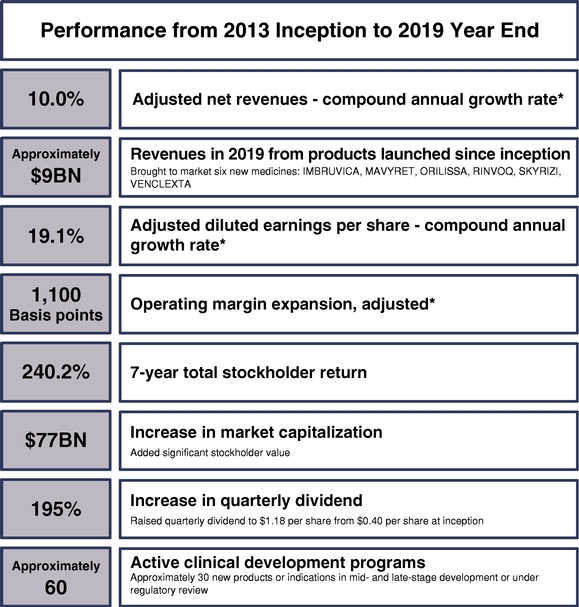

Business Overview and Performance Highlights |

AbbVie was createdSince becoming a public company in 2013, following separation from Abbott Laboratories. AbbVie's mission ishas been to becreate an innovation-driven, patient-focused specialty biopharmaceutical company capable of deliveringachieving sustainable top-tier financial performance through outstanding execution and a consistent stream of innovative new medicines. In 2019, AbbVie intends to continueachieved several new product approvals and continued to advance its missionrobust mid-and late-stage pipeline. Collectively, the new medicines that AbbVie has introduced since inception—including new therapies in a number of ways, including: (i) growing revenues through continued strong performance from its existing portfolio of on-market products, including HUMIRA, IMBRUVICA and MAVYRET, as well as growth from pipeline products; (ii) continued investment in its pipeline in support of opportunities in immunology,rheumatoid arthritis, psoriasis, hematologic oncology and neuroscience, as well as focused investmentshepatitis C virus—represented more than a quarter of AbbVie's total sales in other areas that augment AbbVie's core strengths; (iii) augmentation2019 and will be important contributors in 2020 and beyond. AbbVie delivered another year of outstanding performance in 2019, which reflects the continued strength of its pipeline through concerted focus on strategic licensing, acquisition and partnering activity with a focus on identifying compelling programs that fit AbbVie's strategic criteria; and (iv) continuing to enhance efficiency by expanding operating margins; (v) returning cash to stockholders via dividends and share repurchases.execution across business priorities.

20182020 Proxy Statement | ![]()

![]() 1

1

PROXY STATEMENT SUMMARY |

AbbVie's products are focused on treating conditions such as chronic autoimmune diseases in rheumatology, gastroenterology and dermatology; oncology, including blood cancers; virology, including hepatitis C virus and human immunodeficiency virus; neurological disorders, such as Parkinson's disease; metabolic diseases, including thyroid disease and complications associated with cystic fibrosis; pain associated with endometriosis; as well as other serious health conditions. AbbVie also has a pipeline of promising new medicines in clinical development across such important medical specialties as immunology, oncology and neuroscience, with additional targeted investments in cystic fibrosis and women's health.

In June 2019, AbbVie announced that it entered into a definitive transaction agreement under which AbbVie will acquire Allergan plc (AGN). Allergan is a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical and regenerative medicine products for patients around the world. Allergan markets a portfolio of brands and products primarily focused on key therapeutic areas including aesthetics, eye care, neuroscience, gastroenterology, and women's health.

Business Performance Highlights

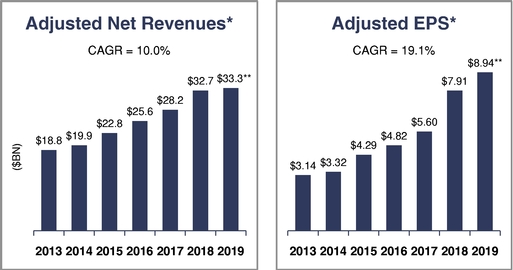

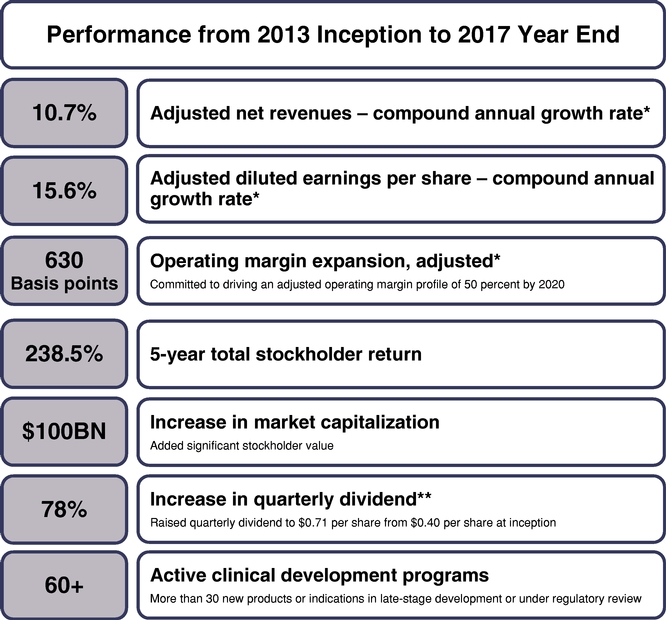

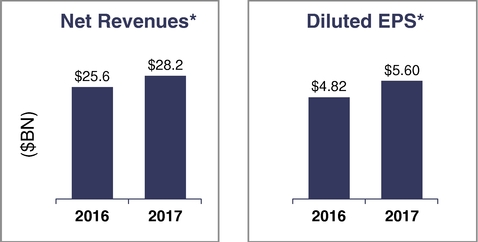

AbbVie has Delivered Robust Financial Results since SeparationInception

The measures set forth above were calculated as of December 31, 2017.2019.

| * | Net revenues, diluted earnings per share and operating margin are adjusted to exclude certain specified items and are non-GAAP measures, which are reconciled in Appendix | |||||

2 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| PROXY STATEMENT SUMMARY |

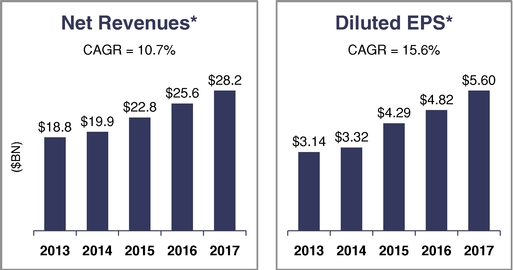

AbbVie has delivered a strong compound annual growth rate (CAGR) since inception on adjusted net revenues and adjusted diluted earnings per share (EPS), placing AbbVie in the top quartile of its Health Care Peer Group.

2 ![]()

|2018 Proxy Statement

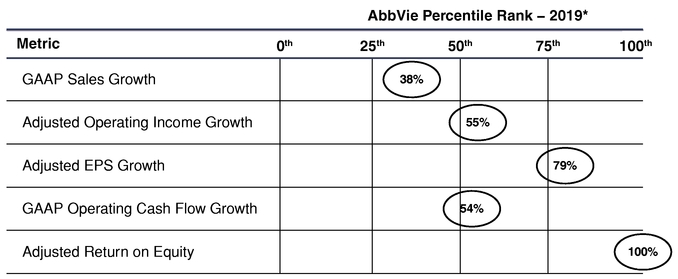

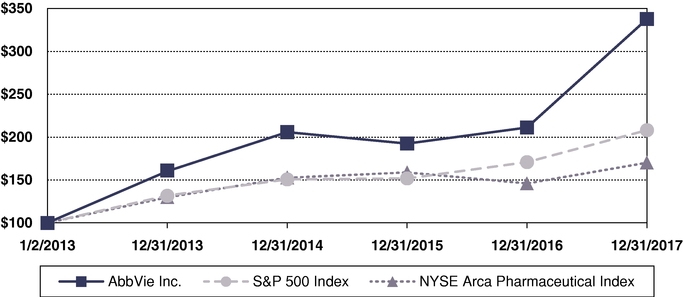

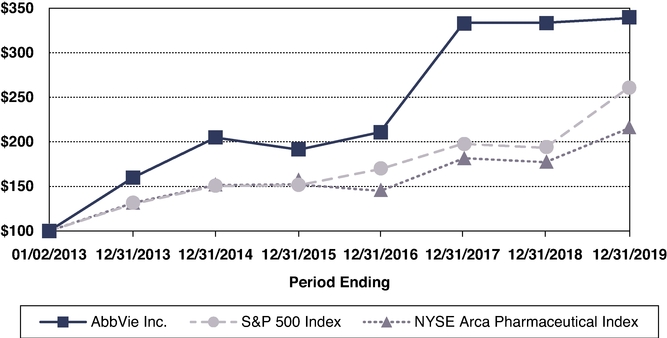

Additionally, AbbVie is committed to a robust return of capital to stockholders with an increase of 78%195% in its quarterly dividend since 2013 as part of a balanced and disciplined capital allocation program. In February 2018, AbbVie increased its dividend by an additional 35%, resulting in a total dividend increase of 140% since AbbVie became an independent company. AbbVie's total stockholder return (TSR) since inception of 238.5%240.2% also places AbbVie at the top of its Health Care Peer Group, and more than 13078 percentage points above the Standard & Poor's 500 Index and more than 168124 percentage points above the NYSE Arca Pharmaceutical Index over the same time period.

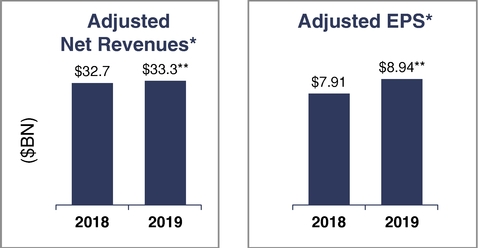

AbbVie has Significantly Grown Revenue and EPS Since 2013

| * | Net revenues and diluted earnings per share are adjusted for specified items, including the impact of intangible asset amortization, and are non-GAAP measures, which are reconciled in Appendix | |||||

** | Year-over-year growth in adjusted net revenues and EPS from 2018-2019 despite significant biosimilar competition for HUMIRA outside the United States. |

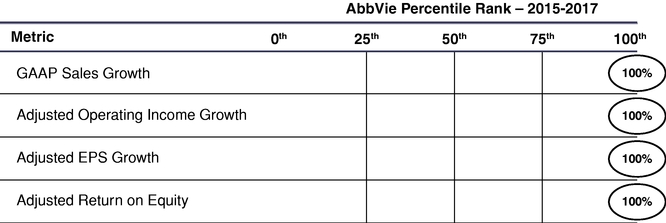

AbbVie has DeliveredDemonstrated an Outstanding Results, Ranking First or Second on Each of the BelowTrack Record, Consistently Delivering Top-Tier Financial MetricsResults

20182020 Proxy Statement | ![]()

![]() 3

3

PROXY STATEMENT SUMMARY |

AbbVie also Delivered Strong Business Performance in 20172019

AbbVie has built a strong foundation for its business and 20172019 was an exceptional year, as evidenced by a number of business highlights:

Corporate Governance Highlights |

Our board of directors is committed to strong corporate governance tailored to meet the needs of AbbVie and its stockholders to enhance long-term stockholder value. In connection with our ongoing, proactive engagement with stockholders (as described in greater detail on page 32)37), AbbVie's board of directors:

4 ![]()

![]() |

| 20182020 Proxy Statement

| PROXY STATEMENT SUMMARY |

provide for a simple majority of shares outstanding for all provisions previously subject to a supermajority provision, as described in Item 6;

Highlights of our governance practices include:

| | | |

| Governance Practice | For more information | |

|---|---|---|

| | | |

| Independent lead director with robust responsibilities is selected by the board | p. | |

| All members of the audit, compensation, and nominations and governance | p. 18 | |

| Ten of AbbVie's eleven directors are independent and regularly meet in executive session | p. 18 | |

| Adopted a proxy access By-Law provision for 3%/3 years | p. | |

| Policyprohibiting hedging and pledging | p. | |

| Robuststock ownership guidelines | p. | |

| Disclosure of our corporatepolitical contributions and ourtrade association dues and oversight process | http://www.abbvie.com/responsibility/transparency-policies/corporate-political-participation.html | |

| p. | ||

| For inclusion on the board, the nominations and governance committee considersdiversity of ethnicity, gender, and geography | p. | |

| Related person transaction policy to ensure appropriate oversight | p. | |

| We do not have astockholder rights plan or "poison pill" | Certificate of Incorporation and By-Laws | |

| Our directors are elected by amajority vote of our stockholders for uncontested elections and we have a resignation policy if the director fails to receive a majority of the votes cast | p. | |

| We hold anannual say-on-pay advisory vote on executive compensation | p. | |

| Our governance guidelines restrict the number of boards our directors may serve on toprevent overboarding | Corporate Governance Guidelines | |

| Annual board and committeeself-assessments and annualsuccession planning | Corporate Governance Guidelines | |

| We are guided by strongethics programs andsupplier guidelines | http://www.abbvie.com/responsibility/home.html |

|

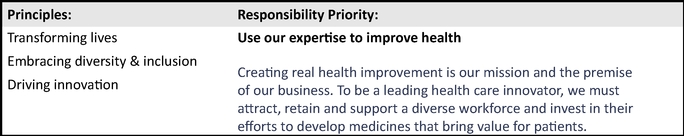

We are passionate about our work to improve lives and go about it in a sustainable and responsible way. AbbVie has strong commitments and a comprehensive approach to corporate responsibility focused on: (i) improving health outcomes, particularly in areas of unmet need, and enhancing access to healthcare across geographies, (ii) operating responsibly and cultivating an ethical, transparent and inclusive culture to drive sustainable growth, and (iii) contributing to communities and addressing challenges of the underserved. The board of directors and public policy

20182020 Proxy Statement | ![]()

![]() 5

5

PROXY STATEMENT SUMMARY |

Corporate Responsibility 2019 Highlights |

At AbbVie, we strive to make a remarkable impact on patients and drive sustainable growth by discovering and delivering a consistent stream of innovative medicines that address serious health problems. In order to drive the long-term sustainability of our business we will continue to make responsible pricing decisions for these medicines, and this is reflected in our long-range plan. Our growth is primarily driven by reaching more patients with innovative new medicines, not increases in price.

In 2019, we launched our company Principles, which anchor our culture and what we believe in. Aligned to our Principles, our corporate responsibility efforts, including how these efforts are incorporated intopriorities guide the ways we advance our business strategy.

Recent examples of Key highlights for the year on these corporate responsibility projectspriorities include:

Attracting and retaining a diverse and inclusive workforce:

Delivering innovative medicines that offer significant health benefit:

AbbVie's corporate responsibility efforts have been consistently recognized by third parties, including: biotech leader on the Dow Jones Sustainability Index in 2016 and 2017 for our strong social, environmental, governance and business practices; score of A- in 2016 and 2017 on climate change by CDP for our disclosure and sustainability efforts; inclusion on Civic 50 for four consecutive years as one of the 50 most community-minded companies in the United States; and inclusion in FTSE4Good since 2016.

More details about our corporate responsibility efforts, key performance indicators, and areas of importance to our stakeholders are available on our website atwww.abbvie.com/responsibility.

6 ![]()

![]() |

| 20182020 Proxy Statement

| PROXY STATEMENT SUMMARY |

blindness will be conducted by our partner, Drugs for Neglected Diseases initiative, with drug product and pro-bono technical support from AbbVie.

Advancing our environmental sustainability priorities:

Stewarding our ethical business:

2020 Proxy Statement |![]() 7

7

PROXY STATEMENT SUMMARY |

quality, compliance and safety, builds trust and underpins strong partnerships. The program reinforces the ways each manager can support integrity:

Leading the industry in workplace safety:

Supporting communities through economic activity, community engagement and philanthropy:

8 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| PROXY STATEMENT SUMMARY |

We also align our commitments to the United Nations' Sustainable Development Goals (SDGs). We focus on Good Health & Well-Being (SDG 3), Quality Education (SDG 4), Gender Equality (SDG 5), Decent Work & Economic Growth (SDG 8), Responsible Production and Consumption (SDG 12), and Climate Action (SDG 13). To further explore our support for the SDGs, please visit globalhealthprogress.org.

For more information about our corporate responsibility efforts, please visit abbvie.com/responsibility.

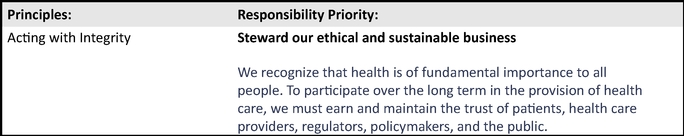

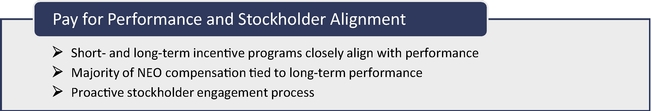

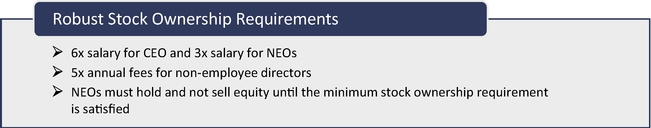

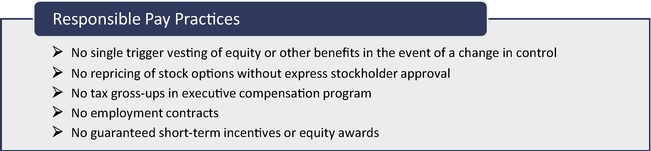

Executive Compensation Highlights |

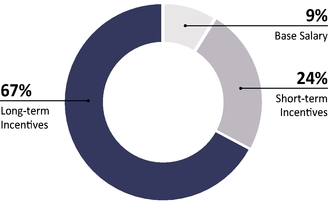

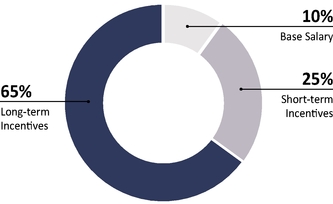

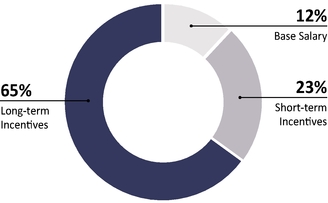

AbbVie's board of directors believes a well-designed compensation program should align executive interests with the drivers of stockholder returns and profitable growth, support achievement of the company's primary business goals, and attract and retain world-class executives whose talents and contributions sustain the growth in long-term stockholder value. Consequently, the compensation committee of the board has designed and implemented an executive compensation program in which a substantial majority of named executive officer (NEO) compensation at AbbVie is performance-based.

When determining NEO compensation, the committee first considers the median of the competitive marketplace (as derived primarily from the Health Care Peer Group approved by the committee) as an initial benchmark for assessing compensation. The committee then takes into account the company's overall performance against the financial, operating and strategic objectives that were established at the start of the performance period. Finally, specific pay determinations are made for each NEO based on his or her individual performance against goals and contributions to the short- and long-term performance of the company.

2020 Proxy Statement |![]() 9

9

PROXY STATEMENT SUMMARY |

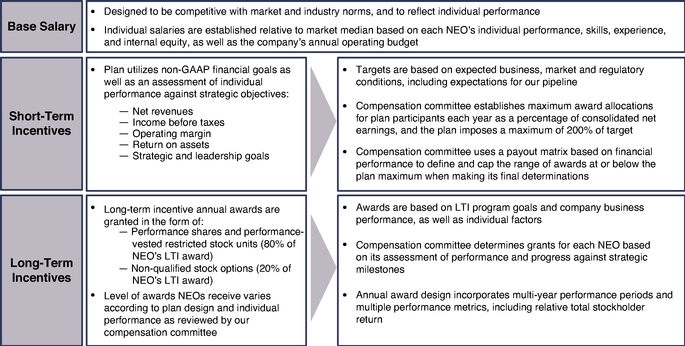

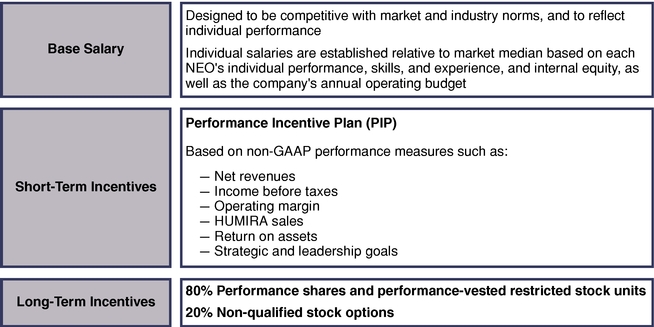

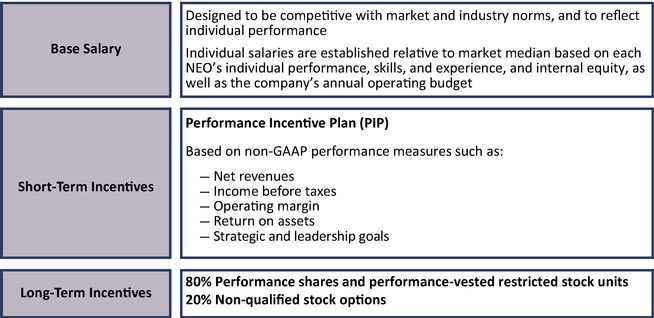

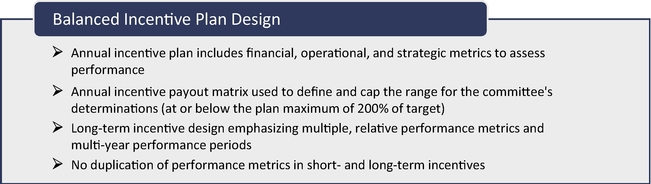

Three primary components make up AbbVie's executive pay program: base salary, short-term incentives and long-term incentives. The structure of each component is tailored to serve a specific function and purpose. The following is a summary of the key components of our compensation program.

2018 Proxy Statement 10 ![]() |2020 Proxy Statement

|2020 Proxy Statement![]()

7

Stockholders of record at the close of business on March 7, 201813, 2020 will be entitled to notice of and to vote atduring the Annual Meeting. As of March 7, 2018,13, 2020, AbbVie had 1,586,687,2361,476,672,808 outstanding shares of common stock, which are AbbVie's only outstanding voting securities. Each stockholder has one vote per share. Stockholders do not have the right to vote cumulatively in electing directors.

In accordance with the Securities and Exchange Commission (SEC) e-proxy rules, AbbVie mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to stockholders in March 2018.2020. The Notice describes the matters to be considered at the Annual Meeting and how stockholders can access the proxy materials online. It also provides instructions on how stockholders can vote their shares. If you received the Notice, you will not receive a printed version of the proxy materials unless you request one. If you would like to receive a printed version of the proxy materials, free of charge, please follow the instructions on the Notice.

AbbVie's stockholders may vote their shares by telephone, the Internet, or atduring the Annual Meeting. If you vote by telephone or the Internet, you do not need to return your proxy card. The instructions for voting can be found on the Notice, on the website listed in the Notice, and, if you received one, on your proxy card. If you requested a printed version of the proxy card, you may also vote by mail.

You may revoke your proxy by voting in person atduring the Annual Meeting or, at any time prior to the meeting:

Discretionary Voting Authority

Unless otherwise specified in accordance with the instructions on the proxy, the persons named in the proxy will vote the shares of AbbVie common stock covered by proxies they receive to elect the four nominees named in Item 1 on the proxy card. If a nominee becomes unavailable to serve, the shares will be voted for a substitute designated by the board of directors or for fewer than four nominees if, in the judgment of the proxy holders, such action is necessary or desirable.

Where a stockholder has specified a choice for or against the proposals to be presented at the Annual Meeting or if the stockholder has chosen to abstain, the shares of AbbVie common stock represented by the proxy will be voted (or not voted) as specified. Where no choice has been specified, the proxy will be voted FOR the ratification of Ernst & Young LLP as auditors, FOR the approval of executive compensation, FOR management's recommendation to hold a vote to approve executive compensation annually, FOR the management proposal regarding the annual election of directors, FOR the management proposal to eliminate supermajority voting, and AGAINST each of the stockholder proposals.

2020 Proxy Statement |![]() 11

11

INFORMATION ABOUT THE ANNUAL MEETING |

The board of directors is not aware of any other issue that may properly be brought before the meeting. If other matters are properly brought before the meeting, the accompanying proxy will be voted in accordance with the judgment of the proxy holders.

8 ![]()

|2018 Proxy Statement

Quorum and Vote Required to Approve Each Item on the Proxy

A majority of the outstanding shares entitled to vote generally in the election of directors, represented in person or by proxy, constitutes a quorum. Directors are elected by stockholders in an uncontested election if a majority of the votes cast are "for" a director's re-election at the Annual Meeting, excluding abstentions and broker non-votes. For other matters, the affirmative vote of a majority of the shares represented, in person or by proxy, at the meeting and entitled to vote on a matter shall be the act of the stockholders with respect to that matter; except for the management proposal regarding the annual election of directors, and the management proposal to eliminate supermajority voting, each of which requirerequires the affirmative vote of shares representing not less than eighty percent (80%) of the outstanding shares of capital stock of AbbVie entitled to vote generally in the election of directors pursuant to Article XI of AbbVie's Amended and Restated Certificate of Incorporation.

Effect of Broker Non-Votes and Abstentions

A proxy submitted by an institution such as a broker or bank that holds shares for the account of a beneficial owner may indicate that all or a portion of the shares represented by that proxy are not being voted with respect to a particular matter. This could occur, for example, when the broker or bank is not permitted to vote those shares in the absence of instructions from the beneficial owner of the stock. These "non-voted shares" will be considered shares not present and, therefore, not entitled to vote on those matters, although these shares may be considered present and entitled to vote for other purposes. Brokers and banks have discretionary authority to vote shares in the absence of instructions on matters the New York Stock Exchange considers "routine," such as the ratification of the appointment of the auditors. They do not have discretionary authority to vote shares in absence of instructions on "non-routine" matters. The election of directors, the advisory vote on the approval of executive compensation, the advisory vote on the frequency of votes to approve executive compensation, the management proposal regarding the annual election of directors, the management proposal to eliminate supermajority voting, and the stockholder proposals are considered "non-routine" matters. Non-voted shares will not affect the determination of the outcome of the vote on any matter to be decided at the meeting. Shares represented by proxies that are present and entitled to vote on a matter but that have elected to abstain from voting on that matter, other than the election of directors, will have the effect of votes against that matter.

The inspectors of election and the tabulators of all proxies, ballots, and voting tabulations that identify stockholders are independent and are not AbbVie employees.

AbbVie will bear the cost of making solicitations from its stockholders and will reimburse banks and brokerage firms for out-of-pocket expenses incurred in connection with this solicitation. Proxies may be solicited by mail, telephone, Internet, or in person by directors, officers, or employees of AbbVie and its subsidiaries.

AbbVie has retained Georgeson Inc.Alliance Advisors LLC to aid in the solicitation of proxies, at an estimated cost of $19,500$15,000 plus reimbursement for reasonable out-of-pocket expenses.

Participants in the AbbVie Savings Plan will receive voting instructions for their shares of AbbVie common stock held in the AbbVie Savings Plan Trust. The Trust is administered by both a trustee and an investment committee. The trustee is The Northern Trust Company. The members of the investment committee are William H.S. Preece, Tabetha A. SkarbekScott T. Reents and Michael J. Thomas, employees of AbbVie. The voting power with respect to the shares is held by and shared between the investment committee and the participants. The investment committee must solicit voting instructions from the participants and follow the voting instructions it receives. The investment committee may use its own discretion with respect to those shares of AbbVie common stock for which no voting instructions are received.

2018 Proxy Statement 12 ![]() |2020 Proxy Statement

|2020 Proxy Statement![]()

9

The board of directors consists of three classes currently comprised of three directors in Class I, four directors in Class II, and four directors or director nominees in Classes II andClass III. Directors of one class are elected each year for a term of three years. The Class IIIII directors are presented for re-election to hold office until the expiration of their term at the 20212023 annual meeting of stockholders and until their successors are elected and qualified or until their earlier death or resignation.

Directors are elected by stockholders if a majority of the votes cast are "for" a director's re-election at the Annual Meeting, excluding abstentions and broker non-votes. For more information on the director majority vote standard, see AbbVie's By-Laws as listed as an exhibit to AbbVie's 20172019 Annual Report on Form 10-K. All of the nominees except for Ms. Roberts, are currently serving as directors. Ms. Roberts was recommended for election by the nominations and governance committee.

Class II—Directors Whose Terms Expire in 2020 |

Director since: 2013 | Robert J. Alpern, M.D. Ensign Professor of Medicine, Professor of Internal Medicine, and Former Dean of Yale School of Medicine Key Contributions to the Board: Through his position as Ensign Professor of Medicine, Professor of Internal Medicine, as well as his previous service as Dean of Yale School of Medicine, Dean of The University of Texas Southwestern Medical Center, and on the board of Yale-New Haven Hospital, Dr. Alpern contributes valuable insights to the board through his medical and scientific expertise and his knowledge of the health care environment and the scientific nature of AbbVie's key research and development initiatives. |

Director since: 2013 | Edward M. Liddy Retired Chairman & CEO, The Allstate Corporation Key Contributions to the Board: Mr. Liddy's executive leadership at Allstate and AIG and his board service at several Fortune 100 companies enable him to provide our board with valuable insights on corporate strategy, risk management, corporate governance and other issues facing large, global enterprises. Additionally, as a former chief financial officer, audit committee chair at Goldman Sachs and 3M, and a private equity firm partner, Mr. Liddy provides our board with significant knowledge and understanding of corporate finance, capital markets, financial reporting and accounting matters. |

2020 Proxy Statement |![]() 13

13

INFORMATION CONCERNING DIRECTOR NOMINEES |

Director since: 2017 | Melody B. Meyer Retired President, Chevron Asia Pacific Exploration and Production Key Contributions to the Board: As a result of her tenure at Chevron, Ms. Meyer has acquired operational, management, strategic planning, and financial expertise with extensive global experience and provides an informed perspective to the board on financial and operational matters faced by a complex international company. | |

Director since: 2013 | Frederick H. Waddell Former Chairman of the Board and Chief Executive Officer of Northern Trust Corporation and The Northern Trust Company Key Contributions to the Board: As former chairman and chief executive officer of Northern Trust Corporation and The Northern Trust Company, Mr. Waddell contributes broad financial services experience with a strong record of leadership in a highly regulated industry. |

Class III—Directors Whose Terms Expire in |

Director since: 2013 | Roxanne S. Austin President, Austin Investment Advisors Key Contributions to the Board: Through her extensive management and operating roles, including her financial roles, Ms. Austin contributes significant oversight and leadership experience to the board, including financial expertise and knowledge of financial statements, corporate finance and accounting matters. |

1014 ![]()

![]() |

| 20182020 Proxy Statement

| INFORMATION CONCERNING DIRECTOR NOMINEES |

| Richard A. Gonzalez Chairman of the Board and Chief Executive Officer, AbbVie Inc. Key Contributions to the Board: As a result of his service as Abbott's executive vice president, Pharmaceutical Products Group, his previous service as Abbott's president and chief operating officer and his more than 30-year career at Abbott, Mr. Gonzalez has developed valuable business, management and leadership experience, as well as extensive knowledge of AbbVie and its global operations. Mr. Gonzalez's experience and knowledge enable him to contribute to AbbVie's board key insights into strategic, management, and operational matters. |

Director | Rebecca B. Roberts Retired President of Chevron Pipe Line Company Key Contributions to the Board: Ms. Roberts brings management, operational, safety, and strategy development expertise with a scientific background and extensive global experience at Chevron. She provides an informed perspective to the board on regulatory and operational matters faced by a complex international company. |

20182020 Proxy Statement | ![]()

![]()

1115

INFORMATION CONCERNING DIRECTOR NOMINEES |

Lead Independent Director Director since: 2013 | Glenn F. Tilton Retired Chairman and Chief Executive Officer of the UAL Corporation Key Contributions to the Board: As chairman of the Midwest for JPMorgan Chase & Co. and having previously served as non-executive chairman of the board of United Continental Holdings, Inc., and chairman, president, and chief executive officer of UAL Corporation and United Air Lines, vice chairman of Chevron Texaco and as interim chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters. His experience as non-executive chairman of the board of United Continental Holdings, Inc. also enhances his contributions as AbbVie's lead independent director. |

Class I—Directors Whose Terms Expire in |

Director since: 2013 | William H.L. Burnside Retired Senior Vice President and Director at The Boston Consulting Group Key Contributions to the Board: Through his experience with The Boston Consulting Group, Mr. Burnside contributes knowledge and understanding of corporate finance and capital markets matters to the board, as well as global and domestic strategic advisory experience across a broad base of industries. |

1216 ![]()

![]() |

| 20182020 Proxy Statement

| INFORMATION CONCERNING DIRECTOR NOMINEES |

Director since: 2016 | Brett J. Hart Executive Vice President and Chief Administrative Officer, Key Contributions to the Board: As an executive vice president and general counsel for two large public companies with international operations and having served as an acting CEO, Mr. Hart contributes operational and strategic acumen with expertise in risk management, legal strategic matters, government and regulatory affairs, customer and external facing matters, corporate governance, and compliance. |

Director since: 2013 | Edward J. Rapp Retired Group President for Resource Industries of Caterpillar Inc. Key Contributions to the Board: As a result of his tenure as group president and chief financial officer at Caterpillar Inc., Mr. Rapp has acquired management, operational, and financial expertise with extensive global experience and provides the board with an informed perspective on financial and operational matters faced by a complex international company. |

|

|

|

20182020 Proxy Statement | ![]()

![]()

13

|

|

| |

|

| |

|

|

14 ![]()

|2018 Proxy Statement17

The Board of Directors |

The board of directors held seveneleven meetings in 2017. All2019. The average attendance of all incumbent directors attended one-hundred percent of theat board and committee meetings in 2017.2019 was ninety-nine percent, and each director attended at least seventy-five percent of the total number of board meetings and meetings of the committees of which he or she served. AbbVie encourages its board members to attend the annual stockholder meeting. All of AbbVie's directors attended the 20172019 annual stockholder meeting.

The board has determined that each of the following individuals is independent in accordance with the New York Stock Exchange (NYSE) listing standards: Dr. Alpern, Ms. Austin, Mr. Burnside, Mr. Hart, Mr. Liddy, Ms. Meyer, Mr. Rapp, Ms. Roberts, Mr. Tilton, and Mr. Waddell. To determine independence, the board applied the AbbVie Inc. director independence guidelines. The board also considered whether a director has any other material relationships with AbbVie or its subsidiaries and concluded that none of these directors had a relationship that impaired the director's independence. This included consideration of the fact that some of the directors are officers or serve on boards of companies or entities to which AbbVie sold products or made contributions or from which AbbVie purchased products and services during the year. This also included consideration of the fact that some of the directors serve on the board of Abbott Laboratories (Abbott), AbbVie's former parent. In making its determination, the board relied on both information provided by the directors and information developed internally by AbbVie.

The board has risk oversight responsibility for AbbVie and administers this responsibility both directly and with assistance from its committees. The board reviews enterprise risks and discusses them with our senior management on a regular basis. AbbVie's risk management program focuses on issues relevant to AbbVie's business, reputation, and strategy, including but not limited to pipeline advancement, healthcare industry dynamics such as pricing and patient access, manufacturing, regulatory and compliance matters, and others. For more details about committee responsibilities and oversight, please see the committee discussion on pages 21-23.

The board also oversees AbbVie's culture, employee engagement, and overall management of human capital. This oversight ensures that AbbVie is attracting, developing, and retaining best-in-class employees dedicated to making a remarkable impact on patients' lives around the world.

The board has determined that the current leadership structure, in which the offices of chairman of the board and chief executive officer are held by one individual and the chair of the nominations and governance committee iswith a board appointed to be the lead independent director, ensures the appropriate level of oversight, independence, and responsibility is applied to all board decisions, including risk oversight, and is in the best interests of AbbVie and its stockholders. The lead independent director is chosen by and from the independent members of the board of directors.

18 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| THE BOARD OF DIRECTORS AND ITS COMMITTEES |

The lead independent director responsibilities include:

1. | reviews and guides agenda items for board meetings; | |

2. | leads the CEO succession planning process; | |

3. | facilitates communication with the board and presides over regularly conducted executive sessions of the independent directors or sessions where the chairman of the board is not present; | |

reviews and approves matters, such as | ||

serves as the liaison between the chairman of the board and the independent directors; | ||

has the authority to call meetings of the independent directors; | ||

leads the board's evaluation of the CEO; | ||

8. | leads the annual board and committee evaluation process, including discussing evaluations with each director individually; | |

9. | encourages effective director participation by fostering an environment of open dialogue and constructive feedback among independent directors; | |

10. | involved in selection and interviewing of new board members; | |

11. | if requested by major stockholders, ensures that he or she is available for consultation and direct communication as needed; | |

12. | if required, represents independent board members externally; and | |

performs such other duties as the board may determine from time to time. |

All directors are encouraged to, and in fact do, consult with the chairman on each of the above topics, as well. The lead director, and each of the other directors, communicates regularly with the chairman of the board and chief executive officer regarding appropriate agenda topics and other board related matters.

2018 Proxy Statement |![]()

15

|

AbbVie directors have backgrounds that when combined provide a portfolio of experience and knowledge that serve AbbVie's governance and strategic needs. Director nominees are considered based on a range of criteria including broad-based business knowledge and relationships, prominence and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship, and ability to commit sufficient time and attention to the activities of the board. They must have demonstrated experience and ability that is relevant to the board's oversight role with respect to AbbVie's business and affairs. They must also be able and willing to represent the stockholders' economic interests and satisfy their fiduciary duties to stockholders without conflicts of interest. For more details on director qualifications, please see Exhibit A to AbbVie's Governance Guidelines.

Each year, the board conducts a self-evaluation to determine whether it and its committees conduct detailed self-evaluations covering topics such as board and committee leadership structure, composition and effectiveness, quality of board and committee materials and discussions, priority agenda items, schedule sufficiency, and board processes. To ensure candid feedback, the evaluations are functioning effectively.anonymous. The full board, led by the lead independent director, discusses the evaluation reports to determine what, if any, actionactions or improvements should be undertaken in the near-term and long-term. The board, committee, and CEO evaluations are discussed in executive session to improve the board and its committees.allow for additional candid discussion.

In the process2020 Proxy Statement |![]() 19

19

THE BOARD OF DIRECTORS AND ITS COMMITTEES |

Each director's biography includes the particular experience and qualifications that led the board to conclude that the director should serve on the board. The directors' biographies are in the section of this proxy statement captioned "Information Concerning Director Nominees."

The following table highlights our directors' skills and experience. The skills identified below are considered by the nominations and governance committee to be the most relevant to the board's oversight role with respect to AbbVie's business and affairs and to drive our culture of innovation and responsibility. The specific importance of each skill also is noted.

Such skills include, among others:

16 ![]()

|2018 Proxy Statement

| Director Skills, Knowledge and Experience Matrix | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| | Healthcare Industry | Leadership | Global Business and Strategy | Corporate Governance and Public Company Board | Finance or Accounting | Government Relations and Regulatory | ||||||

| | | | | | | | | | | | | |

Dr. Alpern | ü | ü | ü | ü | | ü | ||||||

Ms. Austin | ü | ü | ü | ü | ü | ü | ||||||

Mr. Gonzalez | ü | ü | ü | ü | ü | ü | ||||||

Mr. Burnside | ü | ü | ü | ü | ü | |||||||

Mr. Hart | | ü | ü | ü | | ü | ||||||

Mr. Liddy | ü | ü | ü | ü | ü | ü | ||||||

Ms. Meyer | | ü | ü | | ü | ü | ||||||

Mr. Rapp | ü | ü | ü | ü | ü | |||||||

Ms. Roberts | | ü | ü | ü | | ü | ||||||

Mr. Tilton | ü | ü | ü | ü | ü | ü | ||||||

Mr. Waddell | | ü | ü | ü | ü | ü | ||||||

20 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| THE BOARD OF DIRECTORS AND ITS COMMITTEES |

Board Diversity |

AbbVie is committed to diversity in its workforce and on its board of directors. In the process of identifying nominees to serve as a member of the board of directors, the nominations and governance committee considers the board's diversity of ethnicity, gender, age, and geography and assesses the effectiveness of the process in achieving that diversity. More details about our workforce diversity are available in the "Corporate Responsibility Highlights" section of this proxy statement.

Committees of the Board of Directors |

The board of directors has five committees established in AbbVie's By-Laws: the audit committee, compensation committee, nominations and governance committee, public policy committee, and executive committee. Each of the members of the audit committee, compensation committee, and nominations and governance committee, and public policy committee is independent. Mr. Tilton serves as AbbVie's lead independent director.

| | | | | | | | | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | |

| | Audit Committee | Compensation Committee | Nominations and Governance Committee | Public Policy Committee | Audit Committee | Compensation Committee | Nominations and Governance Committee | Public Policy Committee | ||||||||

| | | | | | | | | | | | | | | | | |

| R. Alpern | | | | | ||||||||||||

R. Austin | ||||||||||||||||

W. Burnside | | | | | ||||||||||||

B. Hart | ||||||||||||||||

E. Liddy | | | | | ||||||||||||

M. Meyer | ||||||||||||||||

E. Rapp | | | | | ||||||||||||

R. Roberts | ||||||||||||||||

G. Tilton | ||||||||||||||||

F. Waddell | | | ||||||||||||||

Number of meetings | 6 | 3 | 4 | 4 | 6 | 4 | 4 | 4 | ||||||||

Lead Director | Chairperson | Member | Financial Expert |

2018 Proxy Statement |![]()

17

|

The audit committee is governed by a written charter. ThisThe charter sets forth the purposes of the audit committee, identifies qualifications required for the audit committee members, and describes the committee's authority and responsibilities. The audit committee assists the board of directors in fulfilling its oversight responsibility with respect to AbbVie's accounting and financial reporting practices and the audit process, the quality and integrity of AbbVie's financial statements, including a review of significant accounting policies, the independent auditors' qualifications, independence, and performance, the performance of AbbVie's internal audit function and internal auditors, certain areas of legal and regulatory compliance, and enterprise risk management. Each of the members of the audit committee is

2020 Proxy Statement |![]() 21

21

THE BOARD OF DIRECTORS AND ITS COMMITTEES |

financially literate, as required of audit committee members by the NYSE, and the independence requirements set forth in Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The board of directors has determined that Ms. Austin, the committee's chairperson, is an "audit committee financial expert."

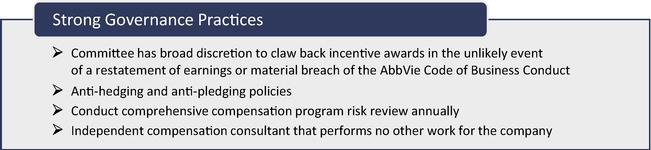

The compensation committee is governed by a written charter. This committee assists the board of directors in carrying out the board's responsibilities relating to the compensation of AbbVie's executive officers and directors. The compensation committee annually reviews the compensation paid to the directors and gives its recommendations to the full board regarding both the amount of director compensation that should be paid and the allocation of that compensation between equity-based awards and cash. In recommending director compensation, the compensation committee takes into account director fees paid by companies in AbbVie's Health Care Peer Group and reviews any arrangement that could be viewed as indirect director compensation. The processes and procedures used for the consideration and determination of executive compensation are described in the "Compensation Discussion and Analysis" section of this proxy statement. The committee also reviews, approves, and administers the incentive compensation plans in which the AbbVie executive officers participate and all of AbbVie's equity-based plans. It may delegate the responsibility to administer and make grants under these plans to management, except to the extent that such delegation would be inconsistent with applicable law or regulations or with the listing rules of the New York Stock Exchange. The compensation committee has the sole authority, under its charter, to select, retain and/or terminate independent advisors who may assist the committee in carrying out its responsibilities. The compensation committee reviews and discusses with management and its independent compensation advisor potential risks associated with AbbVie's compensation policies and practices as discussed in the "Compensation Risk Assessment" section of this proxy statement. Each member of the committee qualifies as a "non-employee director" for purposes of Rule 16b-3 under the Exchange Act and as an "outside director" for purposes of Internal Revenue Code Section 162(m).

The committee has engaged Compensation Advisory Partners (CAP) as its independent compensation consultant. The independent compensation consultant provides counsel and advice to the committee on executive and non-employee director compensation matters. CAP, and its principal, report directly to the chair of the committee. The principal meets regularly, and as needed, with the committee in executive sessions, and has direct access to the committee chair during and between meetings. The committee determines what variables it will instruct CAP to consider, including: peer groups against which performance and pay should be examined, metrics to be used in incentive plans to assess AbbVie's performance, competitive short- and long-term incentive practices in the marketplace, and compensation levels relative to market benchmarks. The committee negotiates and approves all fees paid to CAP for these services. AbbVie did not engage CAP to perform any other services during 2017.2019.

Based on an assessment of internally developed information and information provided by CAP, the committee has determined that its independent compensation advisor does not have a conflict of interest. A copy of the compensation committee report is included in the "Compensation Committee Report" section of this proxy statement.

Nominations and Governance Committee

The nominations and governance committee is governed by a written charter. This committee assists the board of directors in identifying individuals qualified to become board members and recommends to the board the nominees for election as directors at the next annual meeting of stockholders, recommends to the board the persons to be elected as executive officers of AbbVie, recommends to the board the corporate governance guidelines applicable to AbbVie, oversees the evaluation of the board and management, and serves in an advisory capacity to the board and the

18 ![]()

|2018 Proxy Statement

chairman of the board on matters of organization, management succession plans, major changes in the organizational structure of AbbVie, and the conduct of board activities. The process used by this committee to identify a nominee to serve as a member of the board of directors depends on the qualities being sought, as described on pages 16-17.20-21. From time to time, AbbVie engages an executive search firm to assist the committee in identifying individuals qualified to be board members.

22 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| THE BOARD OF DIRECTORS AND ITS COMMITTEES |

The public policy committee is governed by a written charter. This committee assists the board of directors in fulfilling its oversight responsibility with respect to AbbVie's public policy, certain areas of legal and regulatory compliance, governmental affairs, health carehealthcare compliance, and social responsibility and environmental matters that affect or could affect AbbVie by dischargingAbbVie. Other topics within the responsibilities set forth in its charter.committee's purview include but are not limited to ethics and compliance matters, government and regulatory trends relevant to AbbVie's business, political contributions, and corporate philanthropy.

The executive committee members are Mr. Gonzalez, chair, Ms. Austin, Mr. Hart, Mr. Liddy, Mr. Rapp, and Mr. Tilton. This committee may exercise all of the authority of the board in the management of AbbVie, except for matters expressly reserved by law for board action.

Communicating with the Board of Directors |

Stockholders and other interested parties may communicate with the board of directors by writing a letter to the chairman of the board, to the lead director, or to the independent directors c/o AbbVie Inc., 1 North Waukegan Road, AP34, North Chicago, Illinois 60064, Attention: corporate secretary. The corporate secretary regularly forwards to the addressee all letters other than mass mailings, advertisements, and other materials not relevant to AbbVie's business. In addition, directors regularly receive a log of all correspondence received by the company that is addressed to a member of the board and may request any correspondence on that log.

20182020 Proxy Statement | ![]()

![]()

1923

AbbVie employees are not compensated for serving on the board or board committees. AbbVie's non-employee directors are compensated for their service under the AbbVie Non-Employee Directors' Fee Plan and the AbbVie 2013 Incentive Stock Program. As described in "Committees of the Board of Directors—Compensation Committee," director compensation is reviewed annually by the compensation committee with the independent compensation consultant, including a review of director compensation against AbbVie's Health Care Peer Group, and a recommendation is then provided to the full board.

The following table sets forth the non-employee directors' 20172019 compensation.

| Name | Fees Earned or Paid in Cash ($)(1) | Restricted Stock Unit Awards ($)(2) | Option Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | Fees Earned or Paid in Cash ($)(1) | Restricted Stock Unit Awards ($)(2) | Option Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| R. Alpern | | $105,000 | | $184,981 | | $0 | | $20,948 | $25,000 | | $335,929 | | $110,000 | | $189,952 | | $0 | | $50,143 | $25,000 | | $375,095 | ||||||||||||||

| R. Austin | 130,000 | 184,981 | 0 | 0 | 5,319 | 320,300 | 135,000 | 189,952 | 0 | 0 | 8,475 | 333,427 | ||||||||||||||||||||||||

| W. Burnside | | 111,000 | | 184,981 | | 0 | | 0 | 25,000 | | 320,981 | | 116,000 | | 189,952 | | 0 | | 0 | 27,755 | | 333,707 | ||||||||||||||

| B. Hart | 105,000 | 184,981 | 0 | 0 | 25,000 | 314,981 | 121,667 | 189,952 | 0 | 0 | 25,000 | 336,619 | ||||||||||||||||||||||||

| E. Liddy | | 125,000 | | 184,981 | | 0 | | 0 | 0 | | 309,981 | | 130,000 | | 189,952 | | 0 | | 0 | 0 | | 319,952 | ||||||||||||||

| M. Meyer | 64,750 | 184,981 | 0 | 0 | 25,000 | 274,731 | 116,000 | 189,952 | 0 | 0 | 25,000 | 330,952 | ||||||||||||||||||||||||

| E. Rapp | | 131,000 | | 184,981 | | 0 | | 0 | 26,044 | | 342,025 | | 136,000 | | 189,952 | | 0 | | 0 | 26,077 | | 352,029 | ||||||||||||||

| R. Roberts | 110,000 | 189,952 | 0 | 0 | 24,800 | 324,752 | ||||||||||||||||||||||||||||||

| G. Tilton | 150,000 | 184,981 | 0 | 0 | 25,000 | 359,981 | | 169,750 | | 189,952 | | 0 | | 0 | 28,043 | | 387,745 | |||||||||||||||||||

| F. Waddell | | 111,000 | | 184,981 | | 0 | | 0 | 25,000 | | 320,981 | 116,000 | 189,952 | 0 | 0 | 25,000 | 330,952 | |||||||||||||||||||

Fees earned under the AbbVie Non-Employee Directors' Fee Plan are, at the director's election, paid in cash, delivered in the form of vested non-qualified stock options (based on an independent appraisal of their fair value), deferred until retirement (as an unfunded AbbVie obligation), or paid currently into an individual grantor trust established by an eligible director. The distribution of deferred fees and amounts held in a director's grantor trust generally commences at the later of when the director reaches age 65 or upon retirement from the board of directors. Fees deposited in a trust may be credited to a stock equivalent account that earns the same return as if the fees were invested in AbbVie stock or to a guaranteed interest account. If necessary, AbbVie contributes funds

24 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| DIRECTOR COMPENSATION |

to a director's trust so that as of year-end the stock equivalent account balance (net of taxes) is not less than seventy-five percent of the market value of the related AbbVie common stock at year end.

20 ![]()

|2018 Proxy Statement

In addition to the fees described in footnote (1), each non-employee director elected to or serving on the board of directors at the 20172019 annual stockholder meeting received under the AbbVie 2013 Incentive Stock Program vested restricted stock units with a target grant date value of $185,000.$190,000. In 2017,2019, this equated to 2,7702,419 restricted stock units (after rounding the award down to the nearest whole unit), with a reportable value of $184,981.$189,952. The non-employee directors receive cash payments equal to the dividends paid on the shares covered by the units at the same rate as other stockholders, but do not otherwise have access to the restricted stock units during their board service. Upon termination or retirement from the board, death, or a change in control of the company, a non-employee director will receive one common share for each restricted stock unit outstanding under the Incentive Stock Program.

The following AbbVie restricted stock units were outstanding as of December 31, 2017:2019: R. Alpern, 21,789;26,107; R. Austin, 29,452;33,770; W. Burnside, 13,230;17,548; B. Hart, 5,744;10,062; E. Liddy, 17,216;21,534; M. Meyer, 2,770;7,088; E. Rapp, 13,230;17,548; R. Roberts, 4,318; G. Tilton, 25,436;29,754; and F. Waddell, 13,230.17,548. These numbers include, where applicable, AbbVie restricted stock units issued with respect to Abbott Laboratories restricted stock units outstanding when AbbVie separated from Abbott on January 1, 2013.

20182020 Proxy Statement | ![]()

![]()

2125

Securities Ownership of Executive Officers and Directors |

The table below reflects the number of shares of AbbVie common stock beneficially owned as of January 31, 2018,2020, by each director and director nominee, the chief executive officer, the chief financial officer, and the three other most highly paid executive officers (NEOs), and by all directors director nominees and executive officers of AbbVie as a group. It also reflects the number of stock equivalent units and restricted stock units held by non-employee directors under the AbbVie Non-Employee Directors' Fee Plan.

| Name | Shares Beneficially Owned(1)(2)(3) | Stock Options Exercisable within 60 days of January 31, 2018 | Stock Equivalent Units | Shares Beneficially Owned(1)(2)(3) | Stock Options Exercisable within 60 days of January 31, 2019 | Stock Equivalent Units | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

R. Gonzalez | 279,337 | 366,260 | 0 | 334,589 | 770,199 | 0 | ||||||

R. Alpern | 21,789 | 0 | 5,721 | 26,107 | 0 | 6,933 | ||||||

R. Austin | 36,296 | 0 | 0 | 117,114 | 0 | 0 | ||||||

W. Burnside | 13,230 | 0 | 0 | 17,548 | 0 | 0 | ||||||

B. Hart | 5,744 | 0 | 0 | 10,062 | 0 | 0 | ||||||

E. Liddy | 18,351 | 0 | 19,664 | 22,669 | 0 | 24,692 | ||||||

M. Meyer | 2,770 | 0 | 0 | 7,088 | 0 | 0 | ||||||

E. Rapp | 15,498 | 0 | 12,391 | 30,662 | 0 | 16,872 | ||||||

R. Roberts | 0 | 0 | 0 | 4,318 | 0 | 0 | ||||||

G. Tilton | 32,786 | 0 | 29,229 | 42,504 | 0 | 32,020 | ||||||

F. Waddell | 15,230 | 0 | 0 | 19,548 | 0 | 0 | ||||||

W. Chase | 184,044 | 468,307 | 0 | |||||||||

R. Michael | 10,913 | 45,086 | 0 | |||||||||

L. Schumacher | 105,732 | 283,027 | 0 | 164,480 | 335,175 | 0 | ||||||

C. Alban | 155,187 | 432,554 | 0 | 168,319 | 525,299 | 0 | ||||||

M. Severino | 114,922 | 273,483 | 0 | 115,857 | 423,254 | 0 | ||||||

All directors and executive officers as a group(4) | 1,170,082 | 2,292,323 | 67,005 | 1,352,824 | 3,018,896 | 80,517 | ||||||

2226 ![]()

![]() |

| 20182020 Proxy Statement

| SECURITIES OWNERSHIP |

Securities Ownership of Principal Stockholders |

The table below reports the number of shares of AbbVie common stock beneficially owned as of December 31, 20172019 by Capital Research Global Investors, BlackRock, Inc. and The Vanguard Group (directly or through subsidiaries), respectively, the only persons known to AbbVie to own beneficially more than 5% of AbbVie's outstanding common stock. It is based on information contained in Schedules 13G filed with the Securities and Exchange Commission by The Vanguard Group on February 12, 2020, by BlackRock, Inc. on February 5, 2020 and by Capital Research Global Investors on February 14, 2018 and by BlackRock, Inc. and by2020. The Vanguard Group on February 8, 2018. Capital Research Global Investors reported that it had sole voting power with respect to 193,010,7732,293,312 shares, shared voting power with respect to 402,994 shares, sole dispositive power with respect to 120,014,023 shares and shared dispositive power with respect to 2,560,697 shares. BlackRock, Inc. reported that it had sole voting power with respect to 83,787,858 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 193,010,77398,593,810 shares and shared dispositive power with respect to 0 shares. The Vanguard GroupCapital Research Global Investors reported that it had sole voting power with respect to 2,280,419 shares, shared voting power with respect to 346,720 shares, sole dispositive power with respect to 117,283,316 shares and shared dispositive power with respect to 2,569,246 shares. BlackRock, Inc. reported that it had sole voting power with respect to 87,493,57986,601,345 shares, shared voting power with respect to 0 shares, sole dispositive power with respect to 101,322,20186,602,693 shares and shared dispositive power with respect to 0 shares.

| Name and Address of Beneficial Owner | Shares Beneficially Owned | Percent of Class | Shares Beneficially Owned | Percent of Class | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

Capital Research Global Investors | 193,010,773 | 12.0% | ||||||

The Vanguard Group | 119,852,562 | 7.5% | 122,574,720 | 8.3% | ||||

BlackRock, Inc. | 101,322,201 | 6.3% | 98,593,810 | 6.7% | ||||

Capital Research Global Investors | 86,602,693 | 5.8% | ||||||

| | | | | | | | | |

20182020 Proxy Statement | ![]()

![]()

2327

Compensation Discussion and Analysis |

This Compensation Discussion and Analysis (CD&A) describes the pay philosophy established for AbbVie's named executive officers (NEOs), the design of our compensation programs, the process used to examine performance in the context of executive pay decisions, and the performance goals and results for each NEO:

| | | |

| Richard A. Gonzalez | Chairman of the Board and Chief Executive Officer | |

| Executive Vice President, Chief Financial Officer | ||

| Laura J. Schumacher | ||

| Carlos Alban | ||

| Michael E. Severino | ||

| | | |

Although we describe our programs in the context of the NEOs, it is important to note that our programs generally have broad eligibility and therefore in most cases apply to employee populations outside the NEO group as well.

The CD&A is organized as follows:

| I. Executive Summary | ||

Compensation Philosophy | ||

Business Overview | ||

Business Performance Highlights | ||

Components of our Compensation Program | ||

| ||

Stockholder Engagement | ||

Compensation Program Governance Summary | ||

| II. Executive Compensation Process | ||

Commitment to Performance-Based Awards | ||

Committee Process for Setting Total Compensation | ||

Compensation Benchmarking | ||

Role of the Compensation Consultant | ||

Compensation Risk Oversight | ||

| III. Compensation Plan Elements | ||

Base Salary | ||

Short-Term Incentives | ||

Long-Term Incentives | ||

Benefits | ||

Employment Agreements | ||

Excise Tax Gross-Ups | ||

Change in Control Agreements | ||

| IV. Other Matters | ||

Stock Ownership Guidelines | ||

Clawback Policy | ||

Anti-Hedging and Anti-Pledging Policies |

2428 ![]()

![]() |

| 20182020 Proxy Statement

| EXECUTIVE COMPENSATION |

At AbbVie, the board of directors and management believe a well-designed compensation program should align executive interests with the drivers of stockholder returns and profitable growth, support achievement of the company's primary business goals to have a remarkable impact on patients' lives, and attract and retain world-class executives whose talents and contributions sustain the growth in long-term stockholder value. The board believes it has implemented a compensation program that appropriately balances short- and long-term strategic objectives and directly links compensation to stockholder value with more than three-fourths of the total direct compensation paid to NEOs tied to performance. The compensation program also supports the board's philosophy of paying fairly and equitably irrespective of gender and ethnicity.

AbbVie's products are focused on treating conditions such as chronic autoimmune diseases in rheumatology, gastroenterology and dermatology; oncology, including blood cancers; virology, including hepatitis C virus and human immunodeficiency virus; neurological disorders, such as Parkinson's disease; metabolic diseases, including thyroid disease and complications associated with cystic fibrosis; pain associated with endometriosis; as well as other serious health conditions.

Our AbbVie also has a pipeline includes more than 60 compounds or indicationsof promising new medicines in clinical development across such important medical specialties such as immunology, oncology and neuoscience,neuroscience, with additional targeted investmentinvestments in cystic fibrosis and women's health.

In June 2019, AbbVie announced that it entered into a definitive transaction agreement under which AbbVie will acquire Allergan plc (AGN). Allergan is a global pharmaceutical leader focused on developing, manufacturing and commercializing branded pharmaceutical, device, biologic, surgical and regenerative medicine products for patients around the world. Allergan markets a portfolio of brands and products primarily focused on key therapeutic areas including aesthetics, eye care, neuroscience, gastroenterology, and women's health.

20182020 Proxy Statement | ![]()

![]()

2529

EXECUTIVE COMPENSATION |

Business Performance Highlights

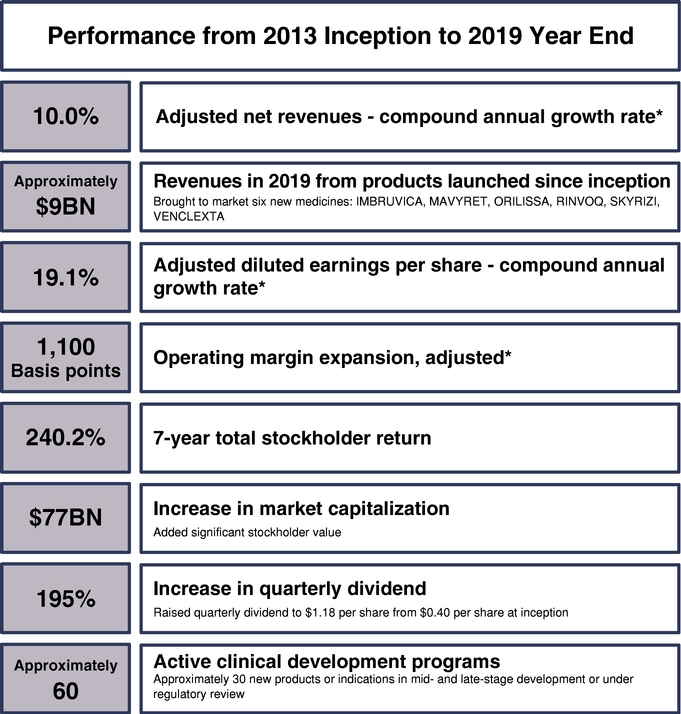

AbbVie has Delivered Robust Financial Results since SeparationInception

The measures set forth above were calculated as of December 31, 2017.2019.

| * | Net revenues, diluted earnings per share and operating margin are adjusted to exclude certain specified items and are non-GAAP measures, which are reconciled in Appendix | |||||

AbbVie has delivered a strong compound annual growth rate (CAGR) since inception on adjusted net revenues and adjusted diluted earnings per share (EPS), placing AbbVie in the top quartile of its Health Care Peer Group. Additionally, AbbVie is committed to a robust return of capital to stockholders with an increase of 78%195% in its dividend since 2013 as part of a balanced and disciplined capital allocation program. In Febuary 2018, AbbVie increased its dividend by an additional 35%, resulting in a total dividend increase of 140% since AbbVie became an independent company. AbbVie's total stockholder return (TSR) since inception of 238.5% also places AbbVie at the top of its Health Care Peer Group, and more than 130 percentage points above the Standard & Poor's 500 Index and more than 168 percentage points above the NYSE Arca Pharmaceutical Index over the same time period.quarterly

2630 ![]()

![]() |

| 20182020 Proxy Statement

| EXECUTIVE COMPENSATION |

dividend since 2013 as part of a balanced and disciplined capital allocation program. AbbVie's total stockholder return (TSR) since inception of 240.2% also places AbbVie at the top of its Health Care Peer Group, and more than 78 percentage points above the Standard & Poor's 500 Index and more than 124 percentage points above the NYSE Arca Pharmaceutical Index over the same time period.

AbbVie also Delivered Strong Business Performance in 20172019

AbbVie has built a strong foundation for its business and 20172019 was an exceptional year, as evidenced by a number of business highlights:

20182020 Proxy Statement | ![]()

![]()

2731

EXECUTIVE COMPENSATION |

The graphs below illustrate AbbVie's growth of net revenue and diluted EPS in 20172019 versus 2016.2018.

| * | Net revenues and diluted earnings per share are adjusted for specified items | |||||

** | Year-over-year growth in adjusted net revenues and EPS from 2018-2019 despite significant biosimilar competition for HUMIRA outside the United States. |

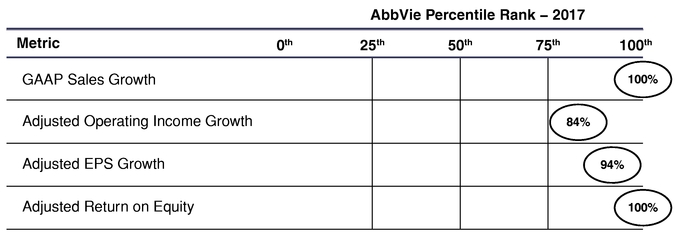

Performance Relative to Peer Group

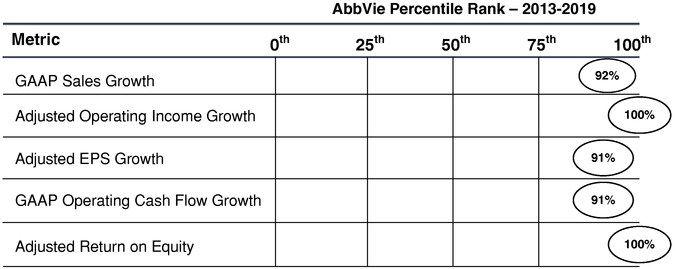

AbbVie is in the top tier of its peers on several financial measures. The chart below outlines AbbVie's six-year performance relative to its Health Care Peer Group in 2017.Group.

2832 ![]()

![]() |

| 20182020 Proxy Statement

| EXECUTIVE COMPENSATION |

In addition,2019, AbbVie has delivered industry-leading performance over the longer term,outperformed its Health Care Peer Group in most of these categories, as demonstrated in the chart below reflecting the company's three-year performance relative to its Health Care Peer Group.below.

| * | Strong financial performance versus peers in 2019 despite significant biosimilar competition for HUMIRA outside the United States. |

20182020 Proxy Statement | ![]()

![]()

2933

EXECUTIVE COMPENSATION |

Total Stockholder Return (TSR) Performance

Over the five years since AbbVie's separation from Abbott, we haveSince becoming a public company in 2013, AbbVie has delivered a total stockholder return of 238.5%240.2%, which places usAbbVie at the top of ourits Health Care Peers and surpasses the cumulative total returns of the Standard & Poor's 500 Index and the NYSE Arca Pharmaceutical Index, as shown in the graph below. The graph covers the period from January 2, 2013 (the first day AbbVie's common stock began "regular-way" trading on the NYSE) through December 31, 2017.2019. The graph assumes $100 was invested in AbbVie common stock and each index on January 2, 2013 and also assumes the reinvestment of dividends. The stock price performance in the following graph is not necessarily indicative of future stock price performance.

Comparison of Cumulative Total Return since AbbVie's Launch

AbbVie is Positioned for Future Growth

AbbVie is well-positioned to deliver strong top- and bottom-line performance through 2020 and beyond. The company has established growth platforms in some ofAbbVie's TSR for calendar year 2019 was 1.5%, which did not reflect the largest and most attractive market segments, including immunology, oncology, virology and neuroscience, and has built a compelling pipeline which will contribute significantly to future performance. AbbVie is committed to top-line growth and operating margin expansion. In October 2017, AbbVie reaffirmed its commitment to meet or exceed the long-term strategiccompany's top tier operational and financial objectives outlined in October 2015. These include an expectation to deliver annual double-digit adjusted EPS growth on average through 2020, company net revenues of approximately $37 billion in 2020, and an adjusted operating margin profile of 50 percent in 2020.performance. As the chart above indicates, despite this 1-year result, AbbVie's returns since launch significantly exceed industry comparisons.

3034 ![]()

![]() |

| 20182020 Proxy Statement

| EXECUTIVE COMPENSATION |

Components of our Compensation Program

The compensation committee of the board oversees our executive compensation program, which includes several compensation elements that have each been tailored to incentivize and reward specific aspects of company performance the board believes are central to delivering long-term stockholder value. Key components of our compensation program are listed below.

The committee is dedicated to ensuring that a substantial portion of executive compensation is "at-risk" and variable. Generally, more than three-fourths of our NEOs' total direct compensation is variable and directly affected by both the company's and the NEO's performance.

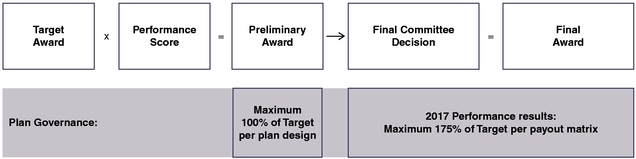

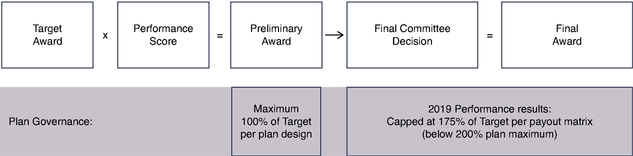

The performance targets established under our annual and long-term incentive plans are rigorous and calibrated to a range of potential outcomes, with above target payouts for strong performance and below target payouts (including no payout) for below target performance. Targets are based on expected business, market and regulatory conditions, including expectations for our pipeline. The financial goals shown in the following table were carried by all of the NEOs as part of their 20172019 performance goals. The specific weightings for each NEO are established at the start of each performance year based on the NEO's role and anticipated contributions to the company's annual objectives. Financial goals are set rigorously; achievement of these targets has resulted in top-tier industry performance.

| Goal and Expected Result(1) | 2018 Actual | 2019 Target | 2019 Target vs. 2018 Actual | 2019 Actual | 2019 Actual vs. 2019 Target | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

| A. | Non-GAAP Net Revenues | $32.3BN(2) | $32.8BN | 102% | $33.3 BN(2) | 101% | ||||||

| B. | Non-GAAP Income Before Taxes | $13.3BN(2) | $14.1 BN | 106% | $14.7 BN(2) | 104% | ||||||

| C. | Adjusted Return on Assets | 23.9% | 30.3% | 127% | 30.5% | 101% | ||||||

| D. | Non-GAAP Operating Margin | $14.4BN(2) | $15.3BN | 106% | $15.8 BN(2) | 103% | ||||||

20182020 Proxy Statement | ![]()

![]()

3135

EXECUTIVE COMPENSATION |

| Goal and Expected Result | Result(1) | Outcome | Performance Against Annual Goals | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| A. | Non-GAAP Net Revenues of $28.1BN | A. | $28.1BN(2) | Achieved | 100% | |||||

| B. | Non-GAAP Income Before Taxes of $10.9BN | B. | $11.2BN | Achieved Above Target | 100% | |||||

| C. | Adjusted Return on Assets of 16.8% | C. | 17.0% | Achieved Above Target | 100% | |||||

| D. | Non-GAAP Operating Margin of $12.0BN | D. | $12.1BN | Achieved Above Target | 100% | |||||

| E. | HUMIRA Sales of $18.4BN | E. | $18.3BN(2) | Achieved | 99% | |||||

In addition to the financial goals set forth above, each of our NEOs also has individual performance goals that the committee reviews and ensures are appropriately rigorous and in line with the long-term success of the company. Each NEO achieved or exceeded his or her 20172019 goals, which are listed below:

Beginning in 2019, our NEOs also took formal 2019 goals aligned to protecting AbbVie's reputation as a top employer and ensuring its long-term sustainability by driving the company's culture in a manner consistent with our Principles.

Key achievements included, for example:

At our 20172019 Annual Meeting, the say on pay proposal received support from 95%over 91% of our stockholders. The board and compensation committee are encouraged by the continued, consistent stockholder support for our executive compensation program.

36 ![]() |2020 Proxy Statement

|2020 Proxy Statement

| EXECUTIVE COMPENSATION |